Giving Smarter

Joyful giving flows from your heart through your head to your hands. Here are smart ways to use your assets and make your philanthropic dreams come true.

-

Giving Now

-

Giving Later

-

Giving Back

Giving Now

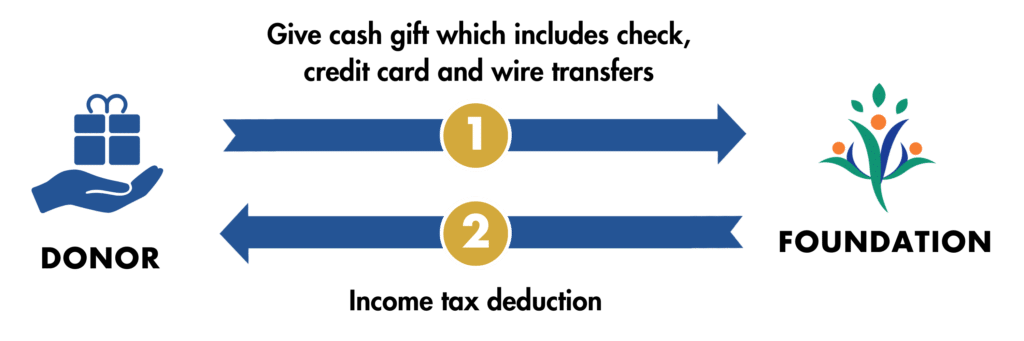

Gifts of Cash

Simplest of all, cash gifts include check, credit card and wire transfers. These offer you the most generous income tax deduction available for charitable contributions.

Donor-Advised Fund

Think of it as a charitable checking account. You donate to the fund and direct how the gifts should be distributed. You can also name us as the ultimate beneficiary.

Retirement Plan

Use your Required Minimum Distribution wisely! Instead of taking it as taxable income, you can have it sent directly to Baptist Homes Foundation tax-free. You can also name us as the ultimate beneficiary.

Stock and Appreciated Assets

Avoid capital gains tax and make a big impact at the same time. Transfer stocks, bonds or mutual fund shares tax-free and receive a charitable deduction. We’ll turn them into meaningful service to those in our care.

Personal Items

You can donate your vehicle, real estate, valuables, mineral interests and more. Call us and we’ll make it easy! We’ll turn them into meaningful service to those in our care.

Giving Later

All these gifts qualify for inclusion in the Evergreen Society

Refundable Entry Fee

Designate a portion of your Refundable Entry Fee to Baptist Homes Foundation. We can direct the gift to the causes that mean the most to you, including named and endowed projects. This gift may also help you avoid estate taxes.

Bequest

Simply add Baptist Homes Foundation to your will or trust. You maintain control of your assets during your lifetime, and there is no upper limit on your estate tax deduction. It’s a gift that costs you nothing during your lifetime with assets you no longer need.

Beneficiary

You can name Baptist Homes Foundation as a final recipient of almost any asset through a simple beneficiary form from the institution—bank accounts, brokerage accounts, retirement plans, donor advised funds, and life insurance policies.

Giving Back

All these gifts provide you with income for life.

Charitable Gift Annuity

A simple gift that sends you regular checks as long as you live. Rates are comparable or better than Certificates of Deposit. Afterward, the Foundation inherits the residual balance.

Secure Act 2.0

The gift of a lifetime! This one-time opportunity allows you to move up to $50,000 from your IRA to purchase a Charitable Gift Annuity.

Charitable Remainder Trust

You create a simple charitable trust which pays you lifelong income. When you are gone, the trust becomes a gift to the Foundation.